Citco is a large, privately owned global hedge fund administrator. It is headquartered in Tortola, in the British Virgin Islands. It is the world’s largest hedge fund administrator. Citco was founded in 1948. The fund manages over $1 trillion in assets under administration. The CEO of Citco is Christopher Smeets. Let’s dive into the important interview questions. Find Citco jobs and apply here. Comment below if you find this article helpful.

Securing your dream job in today’s competitive job market can be a challenging journey. With the landscape of job interviews constantly evolving, it’s essential to have the right tools to help you shine during the CITCO interview questions.

One powerful resource that can significantly enhance your chances of acing an interview is an interview question set. In this blog post, we’ll break down why investing in the CITCO Interview Questions and Answers set PDF is a smart move for your career.

In this blog post, we’ll delve into the compelling reasons why investing in the “CITCO Interview Questions Set PDF File” is a wise decision for your career. Below, I have given a few technical and HR questions, for example. The PDF is really helpful; thank me later.

citco full form

Citco, also known as the Citco Group of Companies and the Curacao International Trust Company,

CITCO Technical Questions

Q1. About the CITCO company?

A: Citco is a large, privately owned global hedge fund administrator. It is the world’s largest hedge fund administrator Citco was founded in 1948. Fund managing over $1 trillion in assets under administration.

The CEO of CITCO is Christopher Smeets. (Verify once)

Q2. NAV and What are the types of NAV?

A: The value of the net asset (NAV) is defined as the value of the assets of the fund minus the value of its liability. In regard to mutual funds, the term ‘net asset value’ is widely used. It is a measure to calculate the value of the assets in funds. NAV is commonly used as a per-share value calculated for a mutual fund.

Types of NAV:

- Daily net asset valuation

- Basic calculation of Net Asset Value

The formula for the NAV is: Total Assets – Total Liabilities/Total Number of outstanding units

Q3. Difference between Mutual funds and Hedge funds

A: Mutual funds are regulated investment products offered to the public and available for daily trading. Where Hedge funds are private investments that are only available to accredited investors, hedge funds are known for using higher-risk investing strategies with the goal of achieving higher returns for their investors.

Q4. Present Sensex value

A: Do Google search for the current Sensex value

Q5. About Hedge funds in detail

A: Hedge funds are another name for investment partnerships. The meaning of the word hedge is to protect oneself from financial losses; thus, Hedge funds are designed to do so. Although a risk factor is always involved, it depends on the return. The higher the risk, the higher the return.

Hedge funds are alternative………….- Look into PDF

+25 Technical Questions Download PDF

All the Questions and Answers related to the Citco interview are in one Download PDF file provided below for only Rs. 249/-

+25 Technical Questions Download PDF

Total 52 guaranteed interview questions, download now and thank me later.

People Also Read: Factset Interview Questions and Answers PDF

People Also Read: EY Interview Questions and Answers PDF

People Also Read: FT Interview Questions and Answers

People Also Read: Genpact Interview Questions and Answers

People Also Read: The Top 20 Most Important Questions In Freshers Job Interviews

People Also Read: MNC Companies Interview Questions For B.Com, MBA, CA, IPCC, PGDM Students

CITCO General/HR Questions

Note: Some of the answers to the questions, you will find here: Click to read

- Self-introduction Click to read the answer

- Family Background – Prepare Own

- How many emails can you respond to and reply to in a day? – Prepare Own

- Previous job role – Prepare Own

- Why I should hire you

Ans: Although I have no experience, I am serious and willing to learn anything. That is to be learned for the enhancement of the growth of the organization as well as the self.

I am also a hardworking, dedicated, trustworthy, and self-motivated person. Finally, I am confident I’ll be the best candidate for this position.

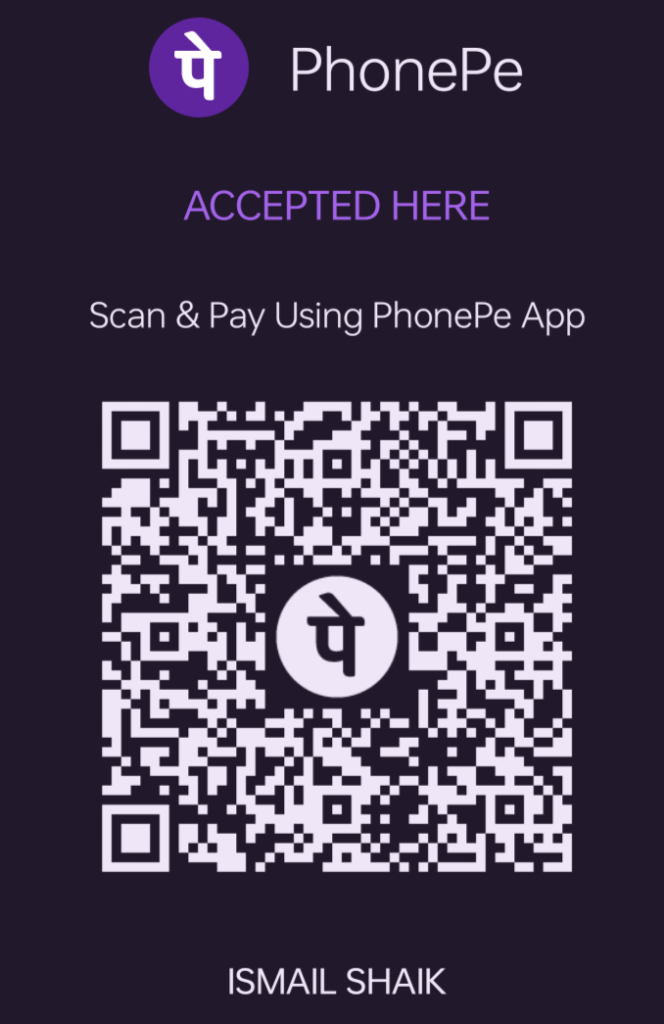

All the Questions and Answers related to the Citco interview are in one PDF Download file provided below for only Rs. 249/-

Want to get a financial JOB at an MNC company?

For your refreshment, the questions and topics covered are Mutual Funds, Corporate Actions, Derivatives, Ratios, and Accounting; Primary and Secondary markets; Forex trading; bonds; Fixed Income Derivatives; Fund accounting; Private Equity and Hedge funds, etc. Overall, from Basic to advanced-level finance and Commerce-based Interview questions

Those questions are going to be shared with you guys for only 1,199₹. To negotiate, mail it to us. Click here to mail. The next document has been prepared with each question to answer, and that will cost around 5,999₹.

The download page is protected. So, After a successful payment, please send a Screenshot via mail to winsomeismailsite@gmail.com and the password will be sent to you immediately. Thanks for the payment. All the best.

Citco company full form, who owns citco, christopher smeets citco, citco locations, citco christopher smeets, citco hyderabad, about citco, citco night shift allowance, hedge fund accounting interview questions

FAQ

Who can buy this PDF file?

Must buy if you have graduated in B.com, Mba, PGDM, CA

Is it a worthy file?

Yes

Should I buy a PDF?

Yes, Because of the Direct Interview questions got from the HR team

Can I negotiate the price?

Yes, Contact us at winsomeismailsitegmail.com

I PAID FOR CITCO INTERVIEW QUESTIONS, BUT FIL NOT FOUND , PLS HELP ME

Hello Kiran,

Now, I hope you got the file from the redirected page. Thanks for the payment.

This PDF file is very helpful in interview preparation. It covers different aspects of finance. Would definetely useful in clearing the interview.

Thanks for the feedback Rama rao, All the best.

I paid for citco interview questions but file not found/ unable to open file at this moment.Pls help.

Hi Vamshi,

Kindly write mail with you payment details winsomeismailsite@gmail.com

Happy to help you.

Thanks & regards

Winsome Ismail